The 3D Secure (3DS) Web Service allows merchants to accept credit card details within their own interface whilst allowing them to authenticate the user via the 3D Secure system. The merchant website utilises Payment Express Merchant Plug-In (MPI) through functionality exposed by way of our Web Service (SOAP based).

Implementing 3DS in the checkout process allows the liability for fraudulent chargebacks (stolen or counterfeit cards) to shift from the merchant to the card issuer.

The following sections cover the integration of the merchant hosted 3D Secure process with our Web Service API.

The live endpoint for 3D Secure SOAP Web Service is available at https://sec.paymentexpress.com/WS/PXWS.asmx

The Web Service description language document for the service is available at https://sec.paymentexpress.com/WS/PXWS.asmx?WSDL

For testing, please use the endpoint https://uat.paymentexpress.com/WS/PXWS.asmx

Test WSDL endpoint: https://uat.paymentexpress.com/WS/PXWS.asmx?WSDL

In order to test the web service a merchant will require a merchant account configured and enabled for 3D secure transactions.

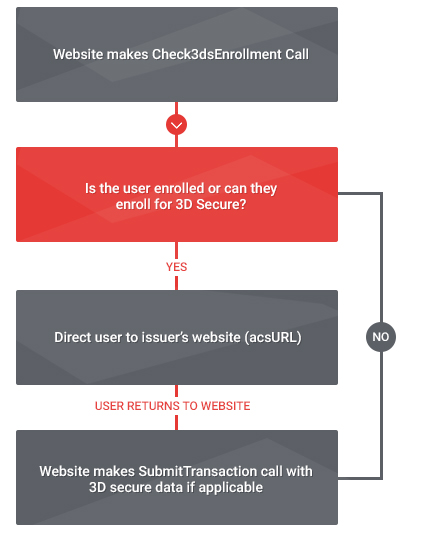

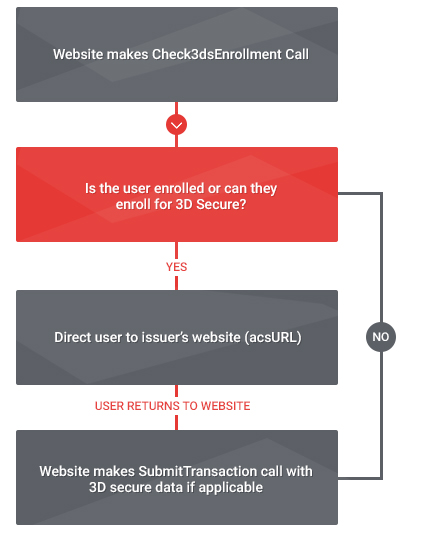

The process flow is documented below. Please visit the linked operations to view the details. The specifications of the relevant operations are:

| Value | Description |

|---|---|

| PaReq | Payer authentication request. The value received in the response to the Check3dsEnrollment response |

| TermUrl | The URL to which the user will be directed at the conclusion of 3D secure authentication |

| MD | Optional free text parameter that can be supplied and will be echoed back when the user is directed back to the TermUrl |

Below is an example of a form containing all of the necessary input values and the optional 'MD' property.

The ACS will accept POST request content as follows:

PaReq= eNp1UttugzAM/RXE+0gosF5kUkFZtT506rp222sUvJatXBqgtPv6JQzW7WFRIvnY1rF9HJie04NxQlkmeeabtkVNAzO

/GAw==&TermUrl=http://localhost:54107/3DSWebService/Default.aspx&MD=1234

7. The user authenticates using the 3D secure service

8. The user is directed back to the URL specified in the TermUrl input parameter by way of client-side POST. POSTed data includes a value named "PaRes" and "MD" will be returned if supplied in step 6. Please note the PaRes value’s length should generally be much longer than the PaReq value which was returned from the Check3dsEnrollment request. If the PaRes value is shorter in length than the PaReq you may receive a declined transaction response in step 9.

9. Post the SubmitTransaction operation using the WSDL, further details specified here, for 3DS card processing with the paRes value (received from step 8). Enter the paRes value only if received the validenrolled flag and paReq in step 4, otherwise please leave it empty. The transaction result fields such as DpsTxnRef, Reco, ResponseText, AuthCode, in the response result from the SubmitTransaction result should be recorded in the merchant server or database for reporting any issues to Payment Express. This processed transactions information is also available on our transaction records which can be extracted from CSV reports or the Payline payment manager portal.

| Value | Description |

|---|---|

| PaRes | Payer authentication response. Value to be included in the SubmitTransaction message |

| MD | The value supplied previously if included in the POST parameters in the request |

Refer to: https://sec.paymentexpress.com/WS/PXWS.asmx?op=Check3dsEnrollment

The input properties to the Check3dsEnrollment call are outlined below

| Element | Description |

|---|---|

| amount | Amount in d.cc format |

| cardNumber | Credit card number (no spaces or other delimiters) |

| dateExpiry | Expiry date of the card in MMYY format |

| txnDescription | Description of transaction |

| txnRef | Set by client to uniquely identify transaction |

| currency | Currency code |

| Element | Description |

|---|---|

| enrolled | Indicates if the card holder is or can enroll for 3D secure |

| paReq | Payer authentication request value |

| acsURL | URL at which the card holder can be authenticated |

| Value | Description |

|---|---|

| -1 | The call has failed for technical reasons - please ensure the SOAP WS request message has correct field values and the API account is valid. |

| 0 | The card is not enrolled for 3D secure |

| 1 | The card is enrolled for 3D secure |

| 2 | The card is not enrolled for 3D secure however the user can be given the opportunity to do so. |